Insurance fraud poses a significant challenge to the industry, leading to substantial financial losses annually. To combat this, private investigators play a crucial role in validating insurance claims, ensuring that only legitimate claims are honored. This article delves into the methodologies employed by these professionals to detect and prevent fraudulent activities.

Initial Assessment and Documentation Review

The investigation process typically begins with a comprehensive review of the claim and associated documentation. Investigators scrutinize the details provided, looking for inconsistencies or anomalies that may indicate potential fraud. This initial assessment sets the foundation for a more in-depth inquiry.

Surveillance Techniques

Surveillance is a pivotal tool in an investigator’s arsenal. By discreetly monitoring a claimant’s activities, investigators can verify whether the individual’s behavior aligns with the reported injuries or limitations. For instance, if a claimant alleges a debilitating back injury but is observed engaging in strenuous physical activities, this discrepancy can be pivotal evidence of fraud.

Background Checks and Data Analysis

Conducting thorough background checks is essential. Investigators examine the claimant’s history, including previous claims, financial status, and any criminal records, to identify patterns or motives for fraudulent behavior. Advanced data analysis techniques, such as machine learning and social network analytics, are increasingly utilized to detect unusual patterns that may suggest fraudulent activity.

Interviews and Statements

Engaging with claimants and witnesses through interviews allows investigators to gather firsthand accounts and assess the credibility of the information provided. Skilled questioning can uncover inconsistencies or contradictions that may not be evident in written statements, further aiding the validation process.

Collaboration with Experts

In complex cases, investigators often collaborate with medical professionals, accident reconstruction specialists, or forensic analysts to gain deeper insights. These experts can provide authoritative opinions that support or refute the legitimacy of a claim, ensuring a thorough evaluation.

Ethical and Legal Considerations

Throughout the investigation, adherence to legal and ethical standards is paramount. Investigators must operate within the boundaries of the law, ensuring that evidence is collected through permissible means to maintain the integrity of the investigation and uphold the rights of all parties involved.

In conclusion, private investigators employ a multifaceted approach to validate insurance claims, combining traditional investigative techniques with advanced data analysis. Their meticulous efforts are instrumental in detecting fraud, protecting the financial integrity of insurance companies, and ensuring that genuine claimants receive the support they deserve.

Protect Your Business from Insurance Fraud

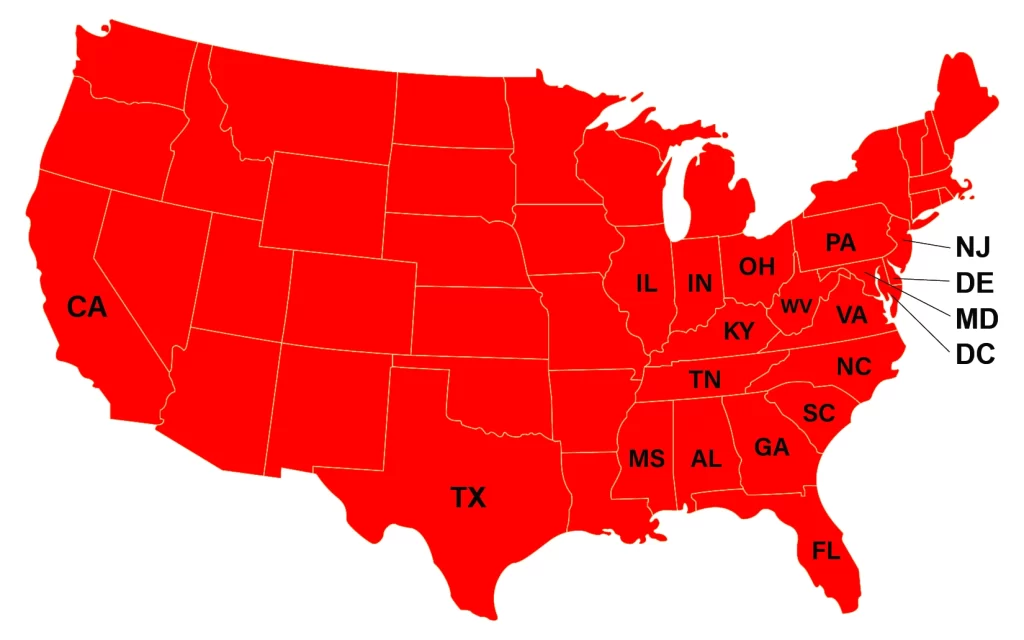

At J.P. Investigative Group, our seasoned special investigations unit is dedicated to uncovering fraud. Don’t let insurance fraud harm your business and customers. We offer comprehensive insurance fraud investigations in Charlotte, North Carolina, surrounding areas, and various states. As a private investigation firm Charlotte, we are committed to providing the best services possible. If you’re looking for a private detective Charlotte, we are here to help.

Contact us today to learn how our services can safeguard your interests!