Insurance fraud is any duplicitous act conducted with the intent of improper payment from the insurance policy provider. It is an ever-increasing crime costing companies billions of dollars each year and drives up premiums for honest policyholders. Unfortunately, many insurance companies can’t detect these frauds, resulting in hefty payouts. Furthermore, insurance frauds are different and can be conducted by buyers and sellers. Hiring a professional private investigator to detect and confirm insurance fraud can protect insurance companies from bearing colossal financial losses.

This blog highlights five reasons to hire a private investigator to prove insurance fraud.

1. Specialized knowledge and expertise

Private Investigators have the specialized skills and expertise to identify insurance frauds and conduct investigations. They can quickly gather evidence, conduct surveillance and analyze data to present the case. Those availing services of private investigators can better determine if a claim is legitimate or fraudulent. Private investigators are well aware of where to look for evidence. Thus, hiring a private investigator can save significant time and money.

2. Access to information

Another reason for hiring a private investigator to confirm insurance fraud is the accessibility to information. You may not have access to some crucial information that can help identify fraudulent activities. Private Investigators have all the skills and training to access medical records, financial records, and other critical details. This not only helps confirm fraudulent claims but also helps build a solid case for litigation purposes.

3. Unbiased investigation

Private investigators will investigate in an unbiased manner. This skill comes in handy, especially when the claimant is a friend or family member of the employee working in an insurance company. Thus, a private investigator will proceed with the investigation unbothered by emotions or personal relationships with the claimant.

4. Surveillance and identification of forgery

There are instances when you may need more evidence. This is where private investigators can help. A private investigator dealing with fraudulent cases can conduct surveillance by using advanced technologies, such as GPS, drones, and audio recording, to extract valuable information. Additionally, they are trained to look for signs of tampering or forgery of documents. For instance, a private investigator can quickly examine invoices, hospital records, and police reports for unlawful changes or tampering.

5. Interview witnesses

Lastly, private investigators can also help you make a strong case by collecting evidence. They can interview witnesses and obtain statements from relevant personnel to support your claim or expose lies.

Hiring a private investigator can help individuals and insurance companies look out for fraudulent insurance claims. They have specialized skills and expertise to conduct unbiased investigations by interviewing witnesses, conducting surveillance, and identifying forgery in documents.

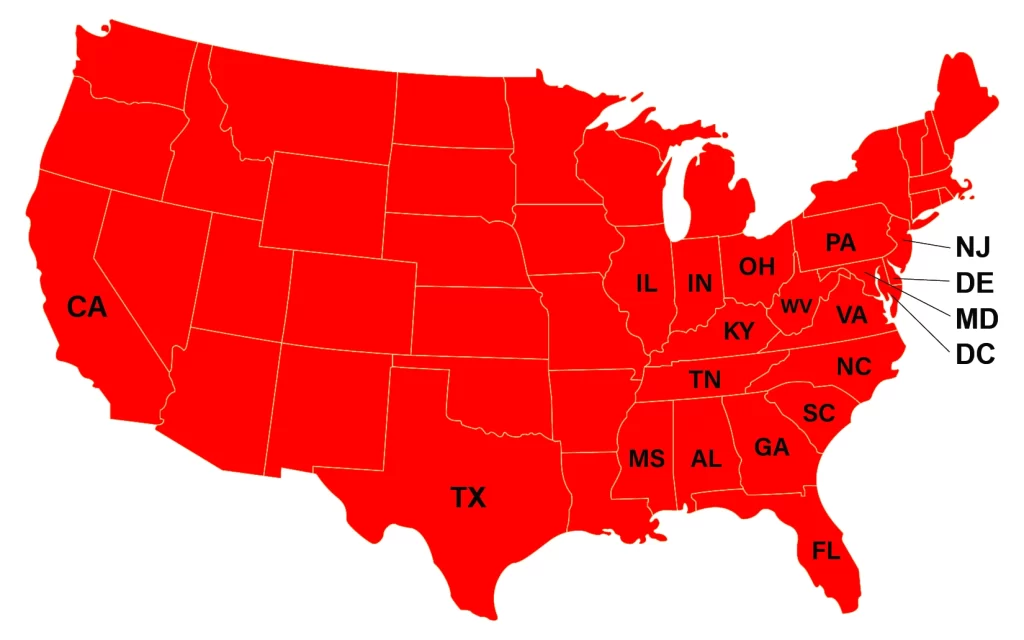

JP Investigative Group helps insurers save thousands of dollars per claim with its insurance fraud investigations in Charlotte

JP Investigative Group’s private investigator insurance fraud brings a keen attention to detail, knowledge of the law, and years of insurance investigations experience to every insurance case it handles.

Give us a call now for more information on our insurance investigation service!